Luxury brand value

With the rise of emerging markets, the luxury goods industry has grown substantially across the world in the past two decades. While customer demand in developed Western markets for luxury brands appears to be buckling under pressures of the recessionary trend, craving for luxury has grown substantially in emerging economies such as China, India, Brazil and Russia. The economic expansion in these emerging markets has obviously increased the desire for global luxury brands among customers. For example, according to Bain & Company estimates, in 2009, 85% of all the new luxury stores opened were in emerging markets.

Since the emerging markets are the growth milestone for luxury brands, it becomes critical for luxury brand managers to understand why consumers buy their brand and what value dimensions trigger the purchase. Value dimensions are the material and non-material qualities/attributes that attract consumers towards certain brands or products and compel them to buy/purchase them. The value dimensions are important not only from a marketing perspective but also because most luxury brands charge a premium for their goods and services making it important to understand what value dimensions will increasingly satisfy the customers.

Early evidence from academic literature suggests that customers in different countries differ significantly in the way they associate with various product categories. This may also be true for luxury brands. However, the earlier results lack empirical strength due to sample choice (i.e. use of student sample rather than real consumers) and anecdotal indication which only captures a single academic or practitioner’s views. To provide an answer to this ambiguity, Keyoor Purani at Indian Institute of Management Kozikode from India and I, conducted a research which looked at the impact of various value dimensions on luxury consumption among British and Indian customers.

The luxury brand value dimensions

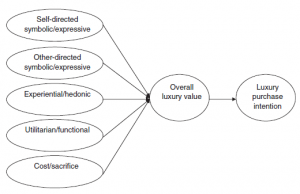

Taking into account the earlier academic work, my study focused on the following specific value dimensions:

(a) Self-directed symbolic value: This dimension focuses on the extent to which customers attach or associate psychological meaning to a luxury brand depending on the product or brand name.

(b) Other-directed symbolic value: This value dimension predicts the extent to which customers focus on and associate value to the social desirability of luxury brands.

(c) Experiential value: This dimension relates to the sensory, emotive experience of consumption. This is especially important for luxury brands as they evoke unique emotions within customer psyche.

(d) Financial value: This value dimension measures the financial risk considered by customers while buying and owning luxury brands.

Understanding British and Indian luxury customers, based on these value dimensions, provides a unique contextual comparison between a developed and an emerging market, a mature versus a rapidly developing market, and cultures of individualism and collectivism. In simple terms, the consumption behaviour of the British and the Indian customers may uncover both similarities and differences, and thus provide an appealing setting for researchers and managers regarding the impact of luxury value dimensions.

Findings relating to luxury brand value dimensions

While looking at the findings, it was observed that British customers considered self-directed symbolic values, other-directed symbolic values as well as financial values while consuming luxury. On the other hand, Indian customers relied heavily on other-directed symbolic values and financial values. This proves that customer values differ significantly across markets.

Customers in developing collectivist markets such as India use simpler selection criteria for measuring value of luxury goods than customers in developed markets like UK. They largely focus on societal and monetary value associated with luxury brands. Therefore, managers who generalise every market’s purchasing pattern may overspend resources in developing markets like India where customer focus is on simpler value dimensions.

British customers exhibited higher levels of psychological attachment than Indian customers. However, the study findings revealed the relationship to be weak and with a downward trend. This implies that British customers are increasingly attaching less psychological meaning to luxury goods. The lessening of psychological meaning suggests that luxury brands are losing their lustre in such developing markets. This may largely be assigned to the democratization of luxury brands where many brands, in a bid to increase their penetration, have become so common that consumers have stopped assigning the quality of luxury with them.

The increased market penetration of luxury brands seems to be working against them as it broadens the customer base but reduces exclusivity. With luxury brands being relatively easily available and consumed by many customers, it creates a dilemma for those original luxury consumers who cannot reflect their self-image anymore through that specific luxury brand, and therefore refrain from consuming such brands in future. This finding has important managerial implications. By increasing their penetration, luxury brands may be able to increase their short-term revenue. However, this may have a long-term negative effect. Hence, luxury brand managers need to be wary of this phenomenon.

As one would expect, Indian consumers rely more on other-directed values than their British counterparts. The finding reflects a collectivist psyche where luxury consumption is seen as a means to achieve social recognition.

Overall, the symbolic value dimension provides luxury brand managers an opportunity to standardize their strategy of marketing luxury brands across different types of markets. Emphasizing the increased social acceptance of luxury consumption may bring them lucrative results in global markets.

The experiential value dimension was found to be non-significant in both countries. This finding provides evidence against prevailing wisdom that luxury goods are consumed for the pleasurable experience they offer. This could be attributed to two main reasons – value contraction and recessionary conditions. Researchers have observed that the increased penetration of luxury goods has led to an overall reduction in their value. Moreover, this may be a reflection of the prevailing economic trend where customers are increasingly demonstrating self-restraint and reducing their pleasure-seeking purchases. The non-significance of experiential values among Indian customers may be a reflection of the cultural element of modesty and humility, which is significantly observed in collectivist societies. Luxury brand managers will have to take these aspects into consideration when developing their communication strategy.

The impact that all these value dimensions have on consumers, as triggers for the intent to purchase certain brands, has not been dealt with in prior studies. The study findings reported here demonstrate that on the whole, luxury value dimensions have significant impact on purchase intentions across markets. However, the British consumers give more credence to their luxury value dimensions in comparison to Indian customers.

Overall, the study findings demonstrate the centrality of value dimensions in influencing customer purchase behaviour regarding luxury brands. However, considerable cross-national variations exist which provide important theoretical insights as well as strategic implications for managers in developing global luxury brand strategy while remaining sensitive to local differences.

Source:

Shukla, P. and K. Purani (2011), “Comparing the Importance of Luxury Value Perceptions in Cross-National Contexts”, Journal of Business Research, Forthcoming.